operating cash flow ratio importance

The other name for this ratio is the Cash Flow Coverage Ratio. The Operating Cash Flow Margin also called the Cash Flow Margin or simply the Margin Ratio is one of the most commonly used profitability ratios.

Cash Flow Formula How To Calculate Cash Flow With Examples

Operating cash flow is the best way to determine whether your business is profitable.

. LENDERS RATING AGENCIES AND. Operating cash flow is particularly important for investors who often look at both OCF and net income when deciding to invest or not. Operating cash flow is an important benchmark to determine the financial success of a companys core business activities.

OCF refers to the cash generated by your business as you go about your day. It should be considered together with other. In the end OCF reveals how much cash is generated from the core operations of your business.

Importance of the cash flow statement Operating cash flows refer to the money your business makes and spends running your daily operations. CASH FLOW RATIOS ARE MORE RELIABLE indicators of liquidity than balance sheet or income statement ratios such as the quick ratio or the current ratio. It would serve a business owner.

The operating cash flow ratio is a measure of how readily current liabilities are covered by the cash flows generated from a companys operations. Cash Flow Ratios. Cash flow ratios are financial ratios in which either the numerator or the denominator or both is a cash flow figure.

Operating cash flow ratio analysis is an effective way to measure how well a company can pay off its current liabilities using the cash flow generated from ongoing business activities. Cash flow ratios are sometimes reserved for advanced financial analysis. Operating Cash Flow Net Income - Changes in Assets and Liabilities Non-Cash Expenses 100000 50000 20000 25000 10000.

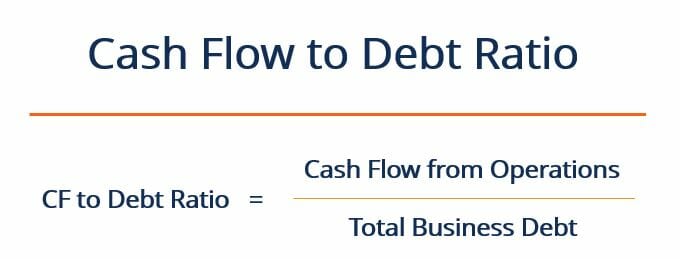

Financial cash flows come. In the case of a small business cash is very important for survival. The formula for the Cashflow to Debt ratio is Cash flow from operationsTotal Debt.

So we can see. Operating cash flow OCF is one of three types of cash flow that are important for business owners to track. Operating cash flow ratio.

Its a measure of how much money you are. This ratio is an important liquidity ratio and is computed using the following formula. While net income shows if the company is.

A higher level of cash flow indicates a better ability to withstand declines in operating performance as well as a better ability to pay dividends to investors. We can get the operating. Knowing the companys free cash flow enables management to decide on future ventures that would improve the shareholder value Valuation Methods When.

A positive figure indicates that your company has a good. Its ability to pay off short-term financial obligations. Operating cash flow ratio is an important measure of a companys liquidity ie.

Why Is Operating Cash Flow Important. Cash flow from operations. Cash Flow Adequacy Ratio Operating cash flows ie.

This is very important to the overall health of your business and the larger. This ratio can help gauge a companys liquidity. The purpose of these cash flow ratios is to provide as much information and detail as possible to cover all bases.

Operating cash flow is the first section depicted on a cash flow statement. Free cash-flow operating cash flow is a significant ratio for users interested in understanding cash that may be available for additional activities. Important cash flow ratios include.

This ratio calculates how much cash a business makes as a result of sales. A preferred operating cash flow number is greater than one because it. That way you can try it out yourself and pick the ones that work for you.

Importance of Free Cash Flow. If the operating cash flow is less than 1 the company has generated less cash in the period than it. The operating cash flow ratio is a measure of a companys liquidity.

Operating Cash Flow 55000.

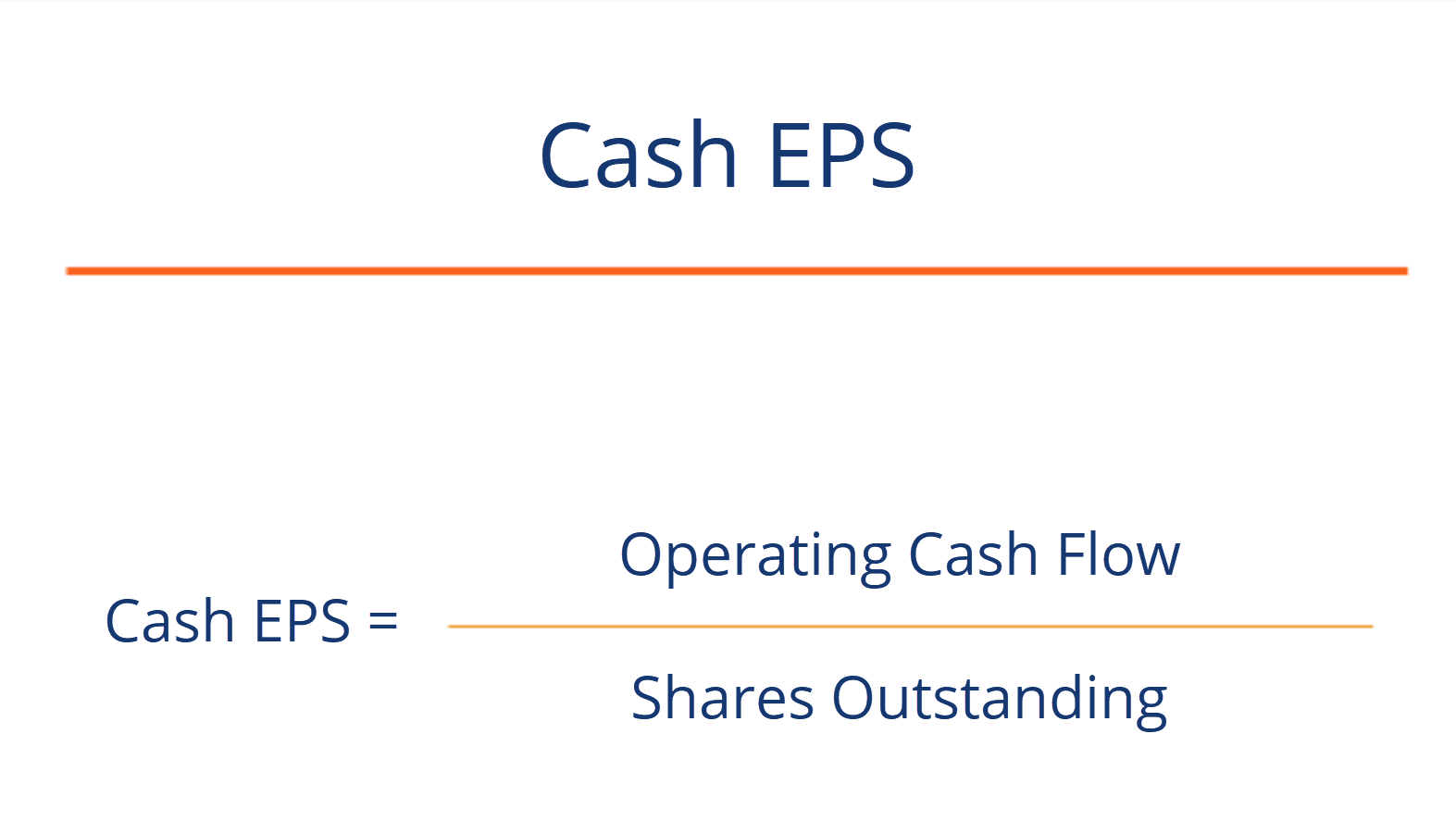

Cash Flow Per Share Formula Example How To Calculate

Fcf Formula Formula For Free Cash Flow Examples And Guide

Price To Cash Flow Formula Example Calculate P Cf Ratio

Cash Flow To Debt Ratio How To Assess Debt Coverage Ability

Cash Flow To Debt Ratio Meaning Importance Calculation

Cash Eps Operating Cash Flow Divided By Shares Outstanding

Free Cash Flow Conversion Fcf Formula And Example Analysis

Cash Flow From Operating Activities Direct And Indirect Method Efm

Free Cash Flow Formula Calculator Excel Template

Operating Cash Flow Ratio Definition Formula Example

Operating Cash Flow Ratio Formula Guide For Financial Analysts

Operating Cash To Debt Ratio Definition And Example Corporate Finance Institute

Price To Cash Flow Formula Example Calculate P Cf Ratio

/applecfs2019-f5459526c78a46a89131fd59046d7c43.jpg)

Comparing Free Cash Flow Vs Operating Cash Flow

Price To Cash Flow Ratio P Cf Formula And Calculation

Operating Cash Flow Definition Formula And Examples

Net Cash Flow Formula Calculator Examples With Excel Template

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)